Trading forecast for June 15

- Wednesday and Thursday were important days for the greenback and the single currency because of Central Bank’s meetings.

- The US dollar index was very volatile on Thursday. At the beginning of the day, it was falling (to $93.20) because of the strengthening euro. Traders anticipated a hawkish speech of the ECB. However, after the Central Bank said it wouldn’t increase the interest rate until summer 2019, the euro plunged.

As a result, the US dollar index broke the psychological level at $94 and moved further. Up to now, the index is moving to the resistance at $94.50. If it’s able to close above it, the further rise is anticipated.

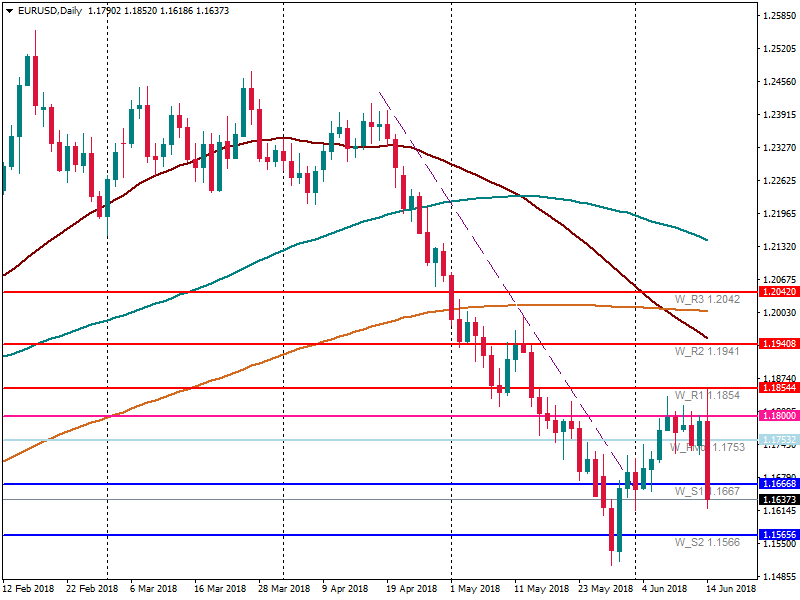

- As we said above, the euro strongly plunged because of the weak ECB forecast on future rate hikes. Firstly, EUR/USD tested the resistance at 1.1850 as the Central Bank announced an end of the QE from October to December this year. However, a weak forecast for future rate hikes pulled the pair below 1.1670. The ECB isn’t going to raise the interest rate until summer 2019.

The euro broke two supports and moving to the next one at 1.1570. On Friday, only Final CPI data will be out (12:00 MT time). The forecast isn’t encouraging, as a result, the euro may reach the support. If the US dollar weakens, and CPI data is greater than the forecast, the euro will have chances to return to the pivot point at 1.1750.

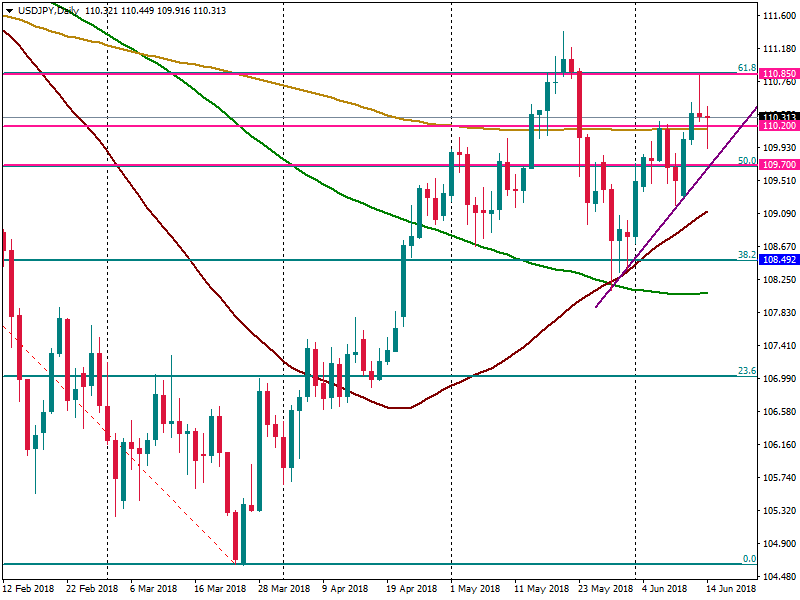

- The USD significantly rose, as a result, other currencies depreciated against the greenback. USD/JPY tested levels below the support at 110.20 (200-day MA) but managed to recover and break it again but bottom-up. The trading isn’t extensive. There are risks of the pair’s fall. On Friday, traders will pay attention to the BOJ meeting. The rate hike isn’t anticipated, however, the BOJ can give clues on the future monetary policy. If the USD is stronger and the BOJ doesn’t give any supportive hints for the yen, the pair will come to the resistance at 110.85 Otherwise, the pair will be below 110.20.