Analysts are predicting a softer May Non-Farm Payroll (NFP) report, with expectations set at 151,000 new jobs, down from 175,000 in the previous month. This conservative forecast follows a recent trend of underestimating the US job market's strength, with the previous miss restoring analysts' confidence in issuing more cautious projections. If the actual NFP figures surpass this modest expectation, it could positively impact the markets. Generally, an NFP above 180,000 is seen as bullish, so meeting the forecast would indicate a slowing but still growing labor market. While the pace of job creation may be decelerating, the expected figures are not indicative of a significant downturn.

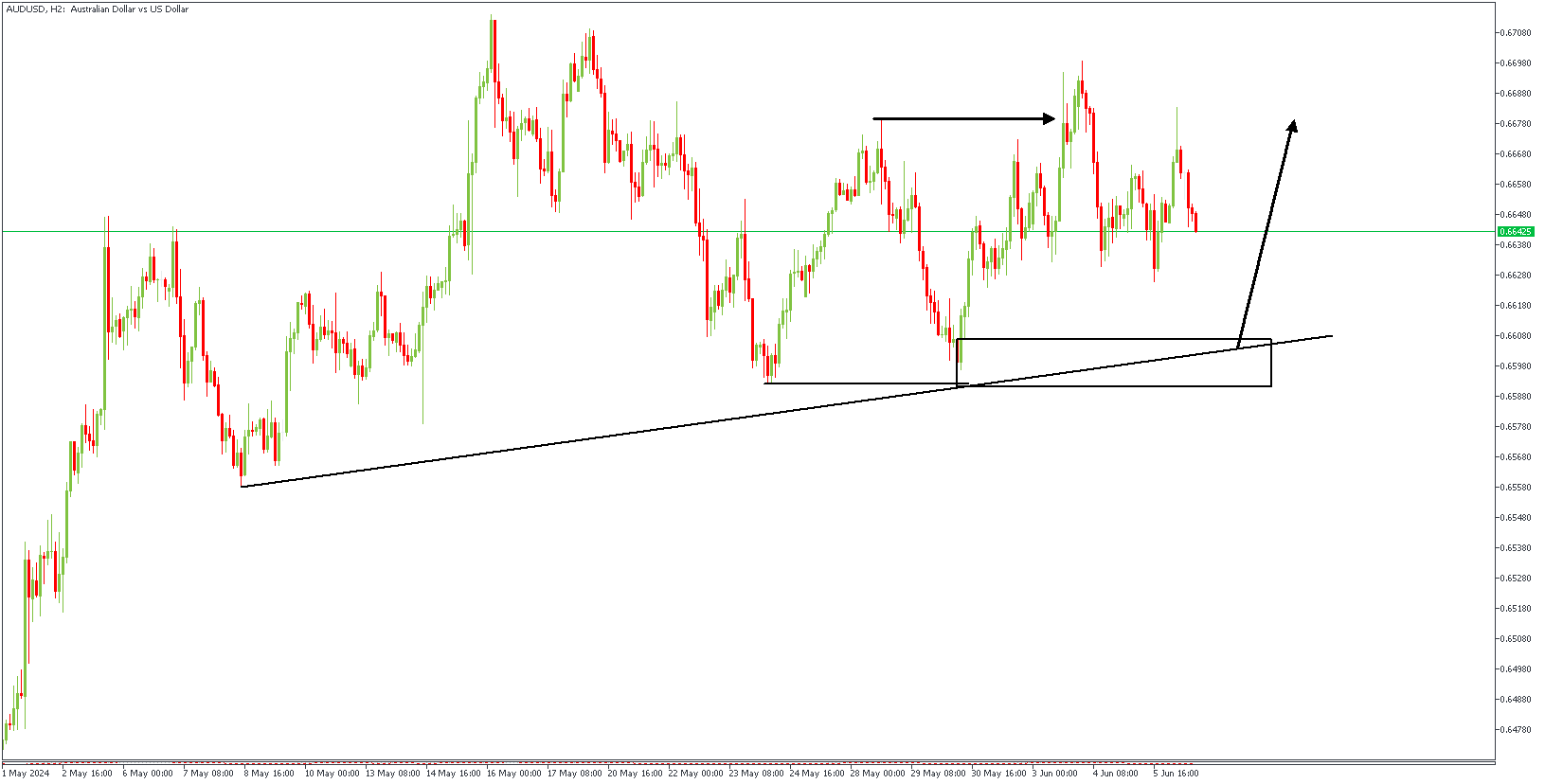

AUDUSD – H2 Timeframe

AUDUSD on the 2-hour timeframe is gradually sliding towards an area of demand that aligns with the demand zone from a previous low that raided liquidity. The previous swing high has also been broken and exceeded, creating a break of structure. The trendline support is expected to complement the bullish pressure, and serving as a confluence to the bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: 0.66840

Invalidation: 0.65848

EURUSD – H2 Timeframe

.png)

On the 2-hour timeframe chart of EURUSD, we can see a clear sweep of the previous low, followed by the bullish break of structure (which I believe you should be familiar with now as a QMR pattern). The 88% of the Fibonacci retracement tool, the drop-base-rally demand zone, and the trendline support are my confluences in favour of a bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: 1.09158

Invalidation: 1.08162

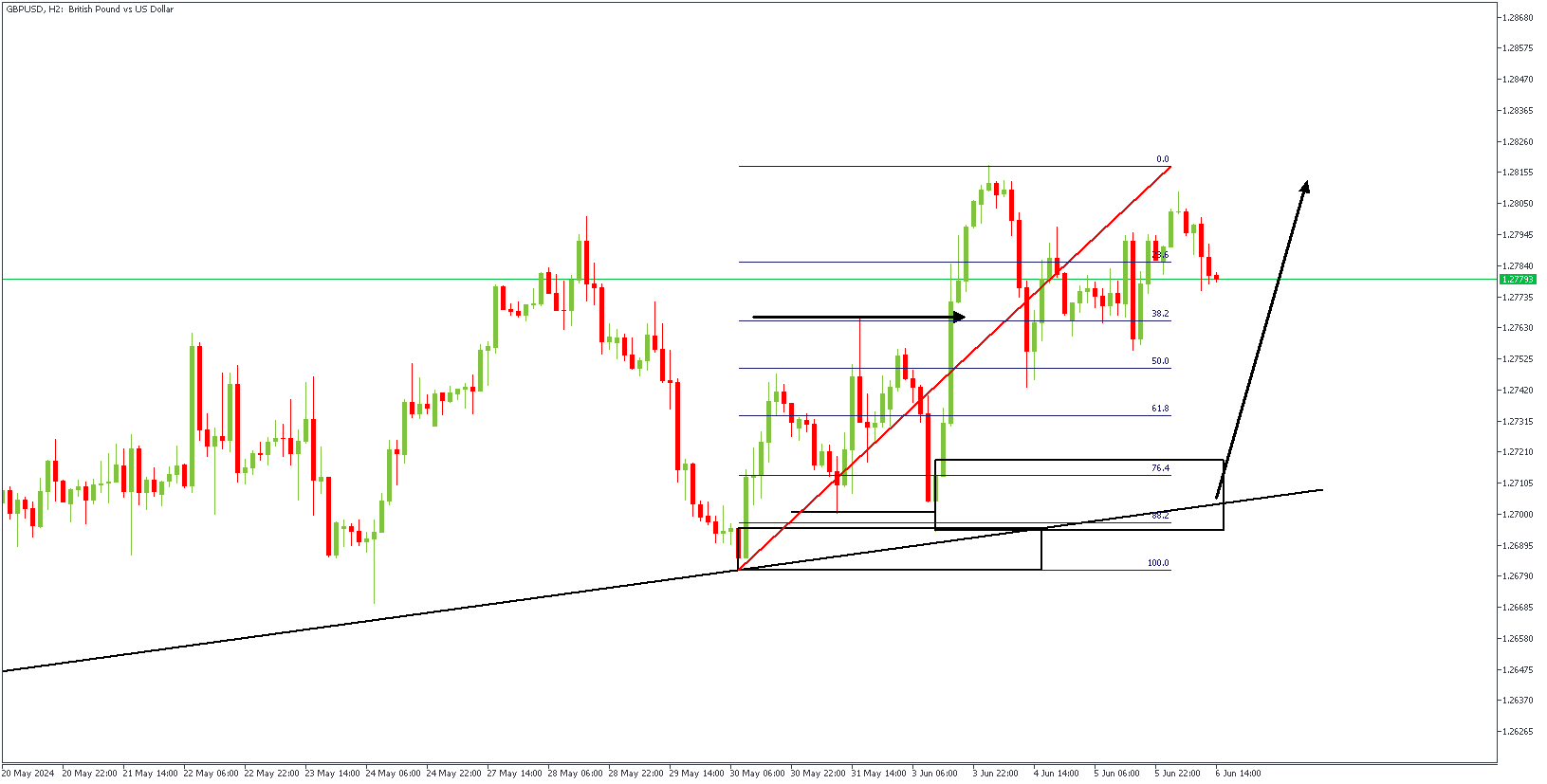

GBPUSD – H2 Timeframe

Quite similar to what we had on EURUSD, we can see GBPUSD on the 2-hour timeframe also printing a clear QMR pattern, however, this time with an added confirmation from the demand zone that birthed the reaction. Following the break above the previous swing high, I expect to see price retrace into the 88% of the Fibonacci, and thereafter pump higher. The trendline support can be considered the final piece of the puzzle that puts the bullish sentiment altogether.

Analyst’s Expectations:

Direction: Bullish

Target: 1.28093

Invalidation: 1.26786

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.