Oil is in the arena

Last week oil showed a great rise. Brent and WTI reached highs of November 2014. Brent tested levels above $80 a barrel, WTI was near $73. However, both oil benchmarks couldn’t stick to new records. On May 28, Brent has slumped to $75 a barrel, WTI has declined to $66.70.

The reason is hidden in an announcement of Saudi Arabia and Russia. Countries signaled they’ll revive output they halted as part of a deal between OPEC and its allies that went into effect in January last year. However, not all of the allies agree with them. Up to now, there is a question whether allies will come to an agreement on the next meeting in Vienna in June or Russia and Saudi Arabia will implement their plan without an approval of allies. As a result, we can anticipate a high volatility of oil at the time of OPEC meeting. According to Saudi Energy Minister, “OPEC and its allies are likely to gradually revive oil output in the second half of the year”. Moreover, Russian President Mr. Putin said that oil prices at $60 a barrel suit Russia and the country doesn’t want them to go higher. He added that anything above that level “can lead to certain problems for consumers, which also isn’t good for producers”.

As OPEC’s output cuts are the major driver of oil prices, it wasn’t a surprise that oil negatively reacted to such comments.

Let’s have a look at charts.

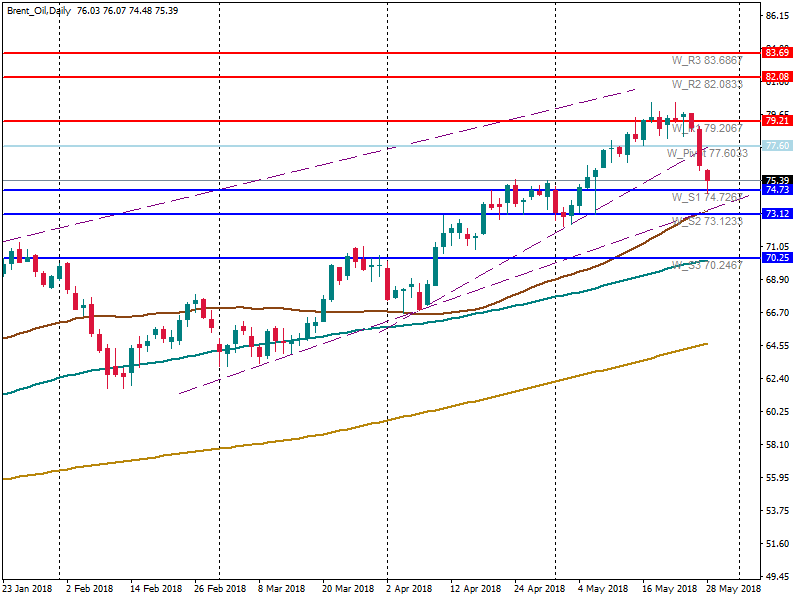

Brent tested the support at $74.70. If it closes below the support, the next aim is at $73 (50-day MA and the pivot point support). If the oil benchmark can’t break the support, the rise to 77.60 will be anticipated.

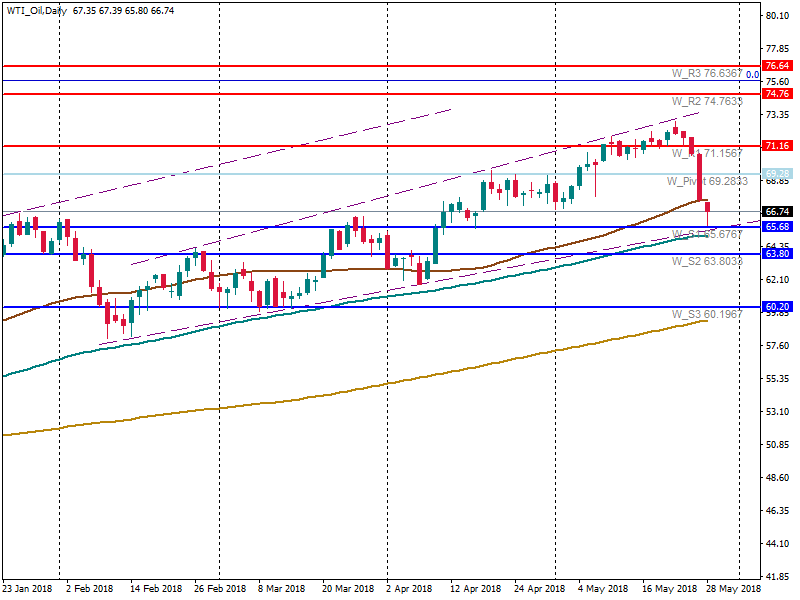

WTI tested the support at 65.70. There is a strong support near that level: 100-day MA, a trendline, and the pivot point support. If WTI is able to break them, a further fall to 63.80 can be anticipated. Otherwise, the oil benchmark will turn around and move up. However, 50-day MA will be a resistance for it. As a result, the further movement of WTI will depend on the news.

Does it mean that past encouraging forecasts changed? No!

Despite comments of OPEC and its allies, Goldman Sachs remains bullish. The bank keeps its forecast for Brent at $82.50 a barrel in the third quarter of 2018. The bank thinks that even if OPEC and allies boost output by 1 million barrels a day, that would only offset involuntary production declines.

Any worries about a shorter demand? Analysts predicted that higher prices will lead to demand’s decline. However, the Bank sees a sustained pace of demand growth even if Brent is at $80 a barrel. Moreover, there are infrastructure problems that will make it harder to bring surging North American production to the market. As a result, the global oil balance will need further increases in OPEC and Russian production in 2019.

As you see a current plunge of oil prices is not a reason to worry. The forecast is still bullish. It’s a good chance to trade on volatility.